- Driver assistance systems aim to save lives but are helping drive up insurance premiums.

- Sensors and cameras are costly to replace and must be calibrated at specialized facilities.

- U.S. insurance rates have been rising for years and may soon reach $2,101 on average.

Driver assistance systems are built to enhance safety and convenience, but they come with an unexpected trade-off: higher insurance rates. While it might seem counterintuitive that features meant to prevent accidents could make things more expensive, these systems aren’t cheap to fix when the vehicles are involved in accidents.

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“0f7e3106-c4d6-4db4-8135-c508879a76f8”);

} else {

adpushup.triggerAd(“82503191-e1d1-435a-874f-9c78a2a54a2f”);

}

});

More: Insurance Companies Are Writing Off Cars Faster Than Ever After Accidents

That seems to be what’s happening, a study that found automatic emergency braking systems have reduced the frequency of claims by 25% in the United Kingdom. That sure sounds like good news but the paradox is that over the course of that five-year period, the cost of claims soared by 60%.

While cameras, radar, and lidar sensors aren’t cheap to replace, there’s more to the process than just swapping out damaged components, according to the study cited by Auto News. In particular, high-tech systems need to be properly calibrated as the publication says a “sensor misaligned by a single degree – about the depth of a business card – can throw it off target by 66 inches (1,676 mm) at a distance of 100 yards (91.4 meters).”

This precision also means there are only a handful of shops that can actually do the work as they reportedly need to have a perfectly level floor, ideal lighting, and “automaker-specific targets to calibrate sensors.” All of this equipment can cost up to $1 million (£738,334 / €878,280), which is a serious investment that only certain shops can afford.

“It’s almost becoming too expensive to fix the car,” said Hami Ebrahimi, chief commercial officer at Caliber Collision told Autonews.

There’s also the question of usefulness as some owners simply turn off driver assistance systems they find annoying. As a result, insurance companies can end up paying a lot to repair systems that drivers don’t even use.

This hurts everyone and the publication pointed to a ValuePenguin study that said the average cost of insurance is expected to hit a record high of $2,101 (£1,551 / €1,845). Technology certainly plays a role in this and automakers are increasingly making advanced safety features standard equipment.

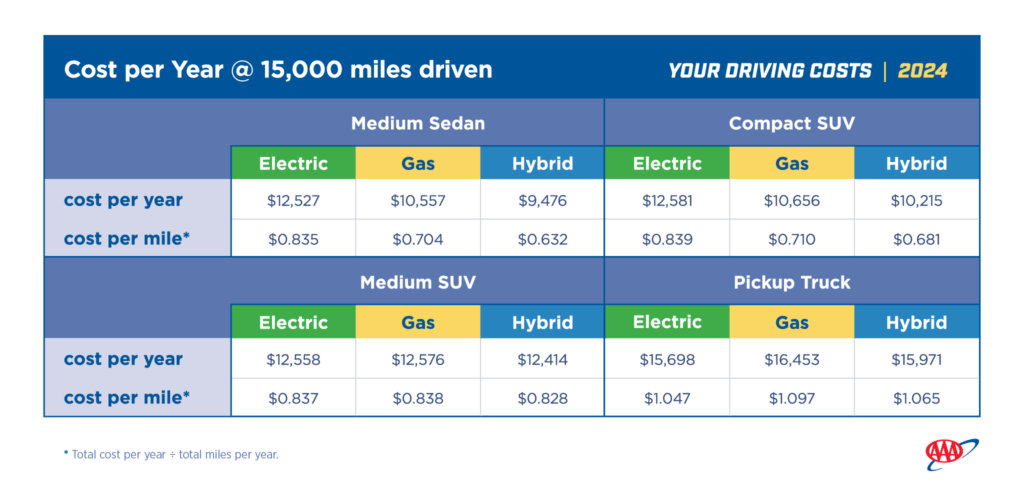

All of this contributes to the rising cost of car ownership. According to a study published last September by the motoring organization AAA, the average annual cost to own and operate a new vehicle has climbed to $12,297, or about $1,024.71 per month. That marks a $115 annual increase compared to the previous year.

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“bb7964e9-07de-4b06-a83e-ead35079d53c”);

} else {

adpushup.triggerAd(“9b1169d9-7a89-4971-a77f-1397f7588751”);

}

});

#Hidden #Feature #Car #Quietly #Raising #Insurance #Bill