Whether this ends up as a blip on the radar or the start of a downward trend is unclear

- Tesla’s revenue fell nine percent year over year during the first quarter which is the worst drop since 2012.

- The stock price is down over 40 percent since the start of the year, but surged 14 percent after today’s earnings call.

- Investors appear to be excited about new announcements about Tesla speeding up its goals surrounding future “affordable models.”

In the wake of an earlier April announcement revealing an 8.5% sales drop in Q1 2024, Tesla brought more bad news during its investor earnings call today. Profits plummeted 55% to $1.1 billion, marking the company’s largest percentage decline since 2012. Furthermore, revenue also dipped by 9% compared to the same quarter in 2023, reaching $21.3 billion.

This downturn surpasses even the setbacks Tesla faced during the 2020 pandemic.

The decrease is the result of several factors. Tesla itself pointed to the Red Sea conflict, an arson attack at Gigafactory Berlin, and the ramp-up of the updated Model 3 as reasons for the decline.

Related: Tesla Sales Fall 8.5% In First Quarterly Drop Since 2020, Retakes EV Leader Crown

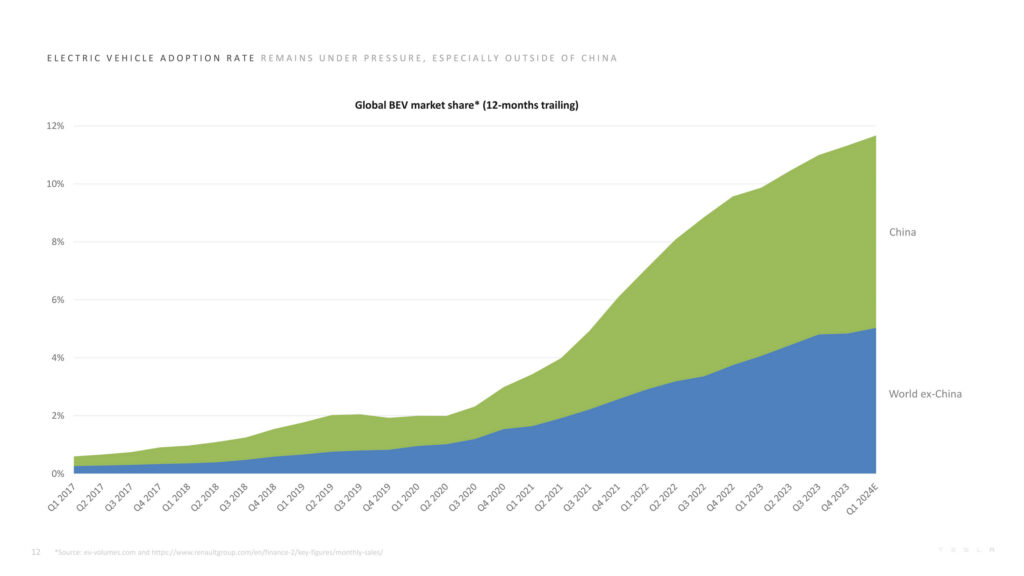

In addition, it cited the intense competition from automakers that are pushing hybrids harder than ever. On top of that, it’s well worth noting that Chinese EVs are also placing plenty of pressure on Tesla.

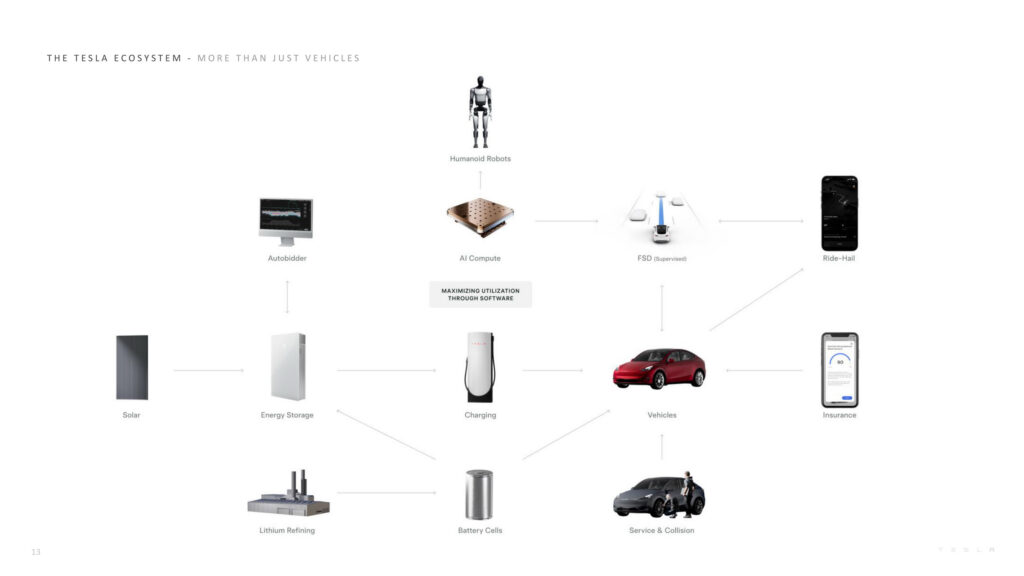

Finally, Tesla highlighted how its investment in future products played a role in its reduced revenue during Q1. “While many are pulling back on their investments, we are investing in future growth – including our AI infrastructure, production capacity, our Supercharger and service networks, and new products infrastructure – with $2.8B of capital expenditures in Q1.”

More Affordable EVs

The comment about “new products infrastructure” is an important one because it gave Tesla fans—and apparently investors, as evidenced by the stock surge—reason to be excited, despite the negative financial news.

In its updated deck, the automaker specifically highlighted its progress on “new vehicles, including more affordable models.” Tesla stated that these vehicles would utilize elements from the next-gen platform as well as current platforms, and they would be manufactured on existing production lines.

While Elon Musk didn’t specify whether these affordable EVs would include a new car like the rumored Model 2 (given his dismissal of recent reports about Tesla canceling plans for it), or perhaps more basic versions of the current range, he did mention that we might see them in the second half of 2025.

“You know, I don’t want to blow your minds, but I’m often optimistic regarding time,” Musk said during the Q&A session. “But our current schedule indicates that we will start production toward the end of 2025, so sometime in the second half. That’s just what our current schedule indicates.”

The Tesla chief said the company would shed more light on the new range during its August 8th robotaxi event. News that the brand is still pursuing these models likely had a hand in the stock price rallying some 14 percent today in after-hours trading.

It’s also worth noting that additional revenue streams appear to be broadening for Tesla. During its earnings call, it also revealed that it’s in talks with one major automaker to license Full Self-Driving technology. In addition, it’ll make additional cash this year as it opens up the Supercharger network to more brands.

#Tesla #Posts #Largest #Revenue #Dip #Shares #Surge #Affordable #Model #News